Overview

While we acknowledge that not all households desire homeownership, not being a homeowner comes at the cost of not being able to build home equity.

In this section, we look across all households, both homeowners and renters, and count households who are not homeowners to have a value of $0 in home equity.

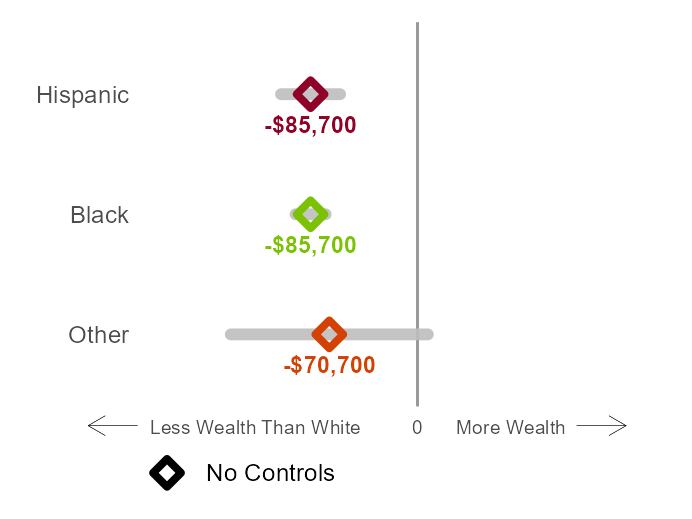

Home equity is unequally distributed between ethno-racial groups in Michigan

This graph shows the differences in median home equity between white and non-white households. For example, the median home equity for Black and Hispanic households is about $86,000 lower than that of white households. Households from other ethno-racial groups have less home equity than white households, but there is a great deal of uncertainty which makes it hard to make any definite conclusions.

Source: Calculations using data from the 2022 SIPP survey.

Notes: The ethno-racial groups shown here are mutually exclusive and collectively exhaustive. They represent a combination of race and ethnicity of the head of the household rather than the entire household. Whenever a given ethno-racial group is too small for reliable statistical analysis, it is grouped with “Other” (see Methodology for more detail). The grey bars represent the margin of error around the estimated median. Wider bars mean that there is more uncertainty around the exact value of the median.

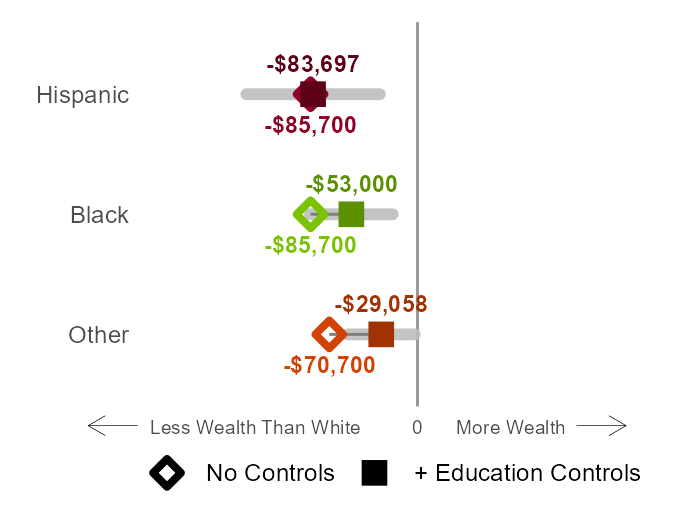

Education and demographic differences account for some of the disparities in home equity in Michigan

Here we examine households with similar demographic characteristics and similar education. The squares in the graph below show the differences in median home equity when comparing households with similar demographics and education. For Black and other households, the difference from white households decreases. For example, when comparing households with similar characteristics and education, Black households have about $53,000 less in home equity, which is a smaller difference than about $87,000 when not comparing households with similar characteristics and education. For Hispanic households the difference is almost non-existent.

However, we should be cautious about drawing definitive conclusions from these figures. The confidence intervals for these estimates are quite wide, which means there's a lot of uncertainty around the exact numbers. In simpler terms, while we can see a general trend, the actual gap could be somewhat larger or smaller than what these specific numbers suggest.

Source: Calculations using data from the 2022 SIPP survey.

Notes: The ethno-racial groups shown here are mutually exclusive and collectively exhaustive. They represent a combination of race and ethnicity of the head of the household rather than the entire household. Whenever a given ethno-racial group is too small for reliable statistical analysis, it is grouped with “Other” (see Methodology for more detail). The grey bars represent the margin of error around the estimated median. Wider bars mean that there is more uncertainty around the exact value of the median. The diamonds represent the differences in median home equity without taking other factors into consideration while the squares represent the model with the controls noted above.

Policy Recommendations

Quality early childhood education access

High-quality early childhood education (ECE) has the potential to improve academic performance and educational attainment and ultimately influence achievements and wages later in a child’s life.1 However, factors such as funding 2 and teacher quality3 for early childhood programs can exacerbate racial disparities if not distributed equitably.

Primary and secondary academic achievement

Academic achievement as early as primary and secondary education directly influences longer-term educational attainment. Racial academic achievement gaps are well-documented4 and set students of color, particularly Black students, up for less optimal workforce outcomes from an early age. Change can be propelled through state task forces or other state-level initiatives focused on racial equity in academic outcomes that set standards or goals for schools and teachers.

College and career readiness

An important aspect of promoting educational attainment is supporting the transition from secondary education to postsecondary education by exposing students early on to education and career steps, ultimately impacting wages and general success in the workforce. College and career readiness programs often target low-income, first-generation college students, which are disproportionately students of color.

Postsecondary education enrollment and completion

The disparities we see in educational attainment are due to both disparities in college enrollment5 as well as completion rates.6 In other words, not only do students need support in getting to college but also in making it to graduation. Barriers to enrollment and completion range from academic unpreparedness, to lack of information about the enrollment process, to prohibitive attendance costs, among others.

When also comparing households with similar income the gap in home equity shrinks

Policy Recommendations

Affordable rental housing costs

Affordable rental housing plays an important role in addressing income disparities that feed into the ethnic and racial disparities in home equity. High rental housing costs can disproportionately burden low-income households, often people of color,7 leaving them with less disposable income to save for a downpayment. States play a crucial role in establishing affordable rental housing, by implementing policies that encourage the development of affordable rental housing (for instance through the establishment of housing trust funds) and providing subsidies or tax incentives to real estate developers to build affordable rental housing, amongst other examples.

Affordable homeowner costs

Affordable homeownership costs can reduce income disparities that contribute to ethnic and racial disparities in home equity. There are many state actions that can help make homeownership more accessible and affordable, for instance through the provision of low-interest mortgage loans or property tax relief programs.

Additionally comparing households with similar savings decreases the home equity gap.

Policy Recommendations

Taxes

Tax policies that address disparities in bank savings can play a significant role in reducing disparities in home equity, given that savings often serve as the foundation for down payments on homes. State governments implement and manage these savings-related tax policies by determining the structure of the state’s tax system, including the rates and types of taxes levied. States can also pass legislation to establish tax credits or deductions.8

Public benefits asset limits

Many public benefit programs—such as cash welfare, food assistance and heating assistance—limit eligibility to those with few or no assets. If individuals or families have assets exceeding the state’s limit, they must “spend down” longer-term savings to receive what is often short-term public assistance. These asset limits, also known as resource limits or asset tests, which were originally created to ensure that public resources did not go to “asset-rich” individuals, are a relic of entitlement policies that in some cases no longer exist.

Differences in non-home debt account for a moderate amount of the ethno-racial disparities in home equity in Michigan

Policy Recommendations

Regulate predatory lending

Predatory lending refers to unfair, deceptive, or fraudulent practices that often disproportionately affect low-income and minority communities, leading to high levels of debt and contributing to disparities in home equity. These loans often carry high interest rates and hidden fees, which can lead to unmanageable debt levels for borrowers. Predatory lending has targeted underserved communities of color.9 It is important for states to regulate these lending practices to prevent borrowers from falling into excessive debt, which can increase their ability to save and build equity in a home.

Debt relief

Debt relief programs, which may include forgiveness, cancellation, or restructuring of debt, can help address ethnic and racial debt disparities, which turn influence home equity disparities. They can free up income and improve credit scores, too.

A large amount of the ethno-racial disparities in home equity in Michigan are still unexplained after considering the above factors

Households of color that look similar in terms of household characteristics, income, liquid savings, and debt are still expected to build less equity than their White counterparts. There are other factors that contribute to ethno-racial disparities in home equity, such as discriminatory lending practices 10, redlining, a lack of intergenerational wealth transfer, later entry into homeownership 11, homeownership financing and the valuation of a home 12 that we were unable to control for here due to a lack of data availability. Besides educational, employment and income disparities and limited access to intergenerational wealth transfers, all of which feed into debt disparities, differences in home equity can be also traced back to historical practices such as redlining and racially restrictive housing covenants. Those practices limited access to affordable housing and credit for Black individuals and have had a lasting impact on Black communities, affecting their ability to accumulate wealth and making them more susceptible to debt 13. Racial and ethnic minorities, particularly Black individuals, also face higher interest rates and less favorable loan terms due to factors such as credit score disparities and discriminatory lending practices 14.

Policy Recommendations

Accessible and affordable lending

Accessible and affordable lending can significantly reduce disparities in home equity by enabling more individuals and households to purchase homes and build home equity. States implement policies that encourage fair lending practices and prevent predatory ones and ensure that financial institutions are serving all communities equitably.

Savings accumulation

Savings are crucial for households to be able to attain and maintain homeownership status. Savings provide for up-front costs such as down payments and closing costs as well as maintenance costs and providing a cushion so households are at less risk for losing their homes in times of financial difficulty.

Intergenerational wealth transfers

Intergenerational wealth transfers, like inheritances, can reduce disparities in home equity by providing individuals with the financial means to purchase homes and pay off mortgages more quickly, thereby building home equity. States can help by implementing policies that facilitate these transfers and asset-building opportunities for future generations, especially for low-income and historically disadvantaged groups.

Home valuation

Fair home valuation can play a pivotal role in reducing disparities in home equity. When homes, particularly in minority communities, are undervalued, homeowners are robbed of potential home equity and wealth accumulation. States can have a substantial role in ensuring fair home valuations by enacting and enforcing laws against biased valuations, requiring regular training for appraisers to ensure fair practices, and providing avenues for homeowners to challenge valuations they believe are unfair.

References

- Georgia Family Connection Partnership. “Long-Term Effects of Early Childhood Education: Beyond Academics.” Georgia Family Connection Partnership, (2021).

- Babbs Hollett, Karen and Erica Frankenberg. “A Critical Analysis of Racial Disparities in ECE Subsidy Funding.” Education Policy Analysis Archives 30, no. 14, (2022).

- Latham, Scott, Sean P. Corcoran and Jennifer L. Jennings. “Racial Disparities in Pre-K Quality: Evidence From New York City’s Universal Pre-K Program.” Educational Researcher 50, no. 9, (2021).

- National Assessment of Educational Progress. “Achievement Gaps Dashboard.” The Nation’s Report Card. National Assessment of Educational Progress, (Accessed 2023).

- Reber, Sarah and Ember Smith. “College Enrollment Disparities: Understanding the Role of Academic Preparation.” Center on Children and Families at Brookings, (2023).

- National Center for Education Statistics. “Indicator 23: Postsecondary Graduation Rates.” Status and Trends in the Education of Racial and Ethnic Groups. Institute of Education Sciences, (2019).

- PD&R Edge. “Rental Burdens: Rethinking Affordability Measures.” U.S. Department of Housing, (Accessed 2023).

- Huang, Chye-Ching, and Roderick Taylor. “How the federal tax code can better advance racial equity.” Washington DC: Center on Budget and Policy Priorities. Retrieved September 21 (2019): 2020.

- Taylor, John, Josh Silver, and David Berenbaum. “The targets of predatory and discriminatory lending: who are they and where do they live.” Why the poor pay more: How to stop predatory lending (2004): 25-37.

- Conklin, James, Kristopher Gerardi, Lauren Lambie-Hanson. “Can Everyone Tap into the Housing Piggy Bank? Racial Disparities in Access to Home Equity.” FRB Atlanta Working Paper No. 2022-17, (2022).

- Choi, Jung Hyun, Alanna McCargo, and Laurie Goodman. “Three Differences between Black and White Homeownership That Add to the Housing Wealth Gap.” Urban Wire. Urban Institute, (2019).

- Narragon, Melissa, Danny Wiley, Vivian Li, Zhiqiang Bi, Kangli Li and Xue Wu. “Research Note: Racial & Ethnic Valuation Gaps in Home Purchase Appraisals – A Modeling Approach.” Freddie Mac, (2022).

- Hernandez, Jesus. “Redlining Revisited: Mortgage Lending Patterns in Sacramento 1930- 2004.” International Journal of Urban Regional Research 33, no. 2, (2009): 291–313.

- Hanifa, Raheem. “High-Income Black Homeowners Receive Higher Interest Rates Than Low-Income White Homeowners.” Joint Center for Housing Studies of Harvard University. HarvardUniversity, (2021).